Written by Jackson Cornelius, From Zonda Urban

Real Estate Market Report | Canada | December 2022

Learn about how home sales and prices are impacted by Canada's economic picture

Detailed report from Zonda Urban

Canada’s Labour Market

Unemployment decreased across all major Canadian markets highlighting the continued tightness experienced in labour markets. Canada’s labour market added a net 10,100 jobs in the month of November that included the addition of 50,700 full-time positions and a loss of 40,600 part-time positions.

Labour force participation rates remain low and recorded moderate losses across all major cities which is consistent with historical year-end trends as baby boomers continue to retire.

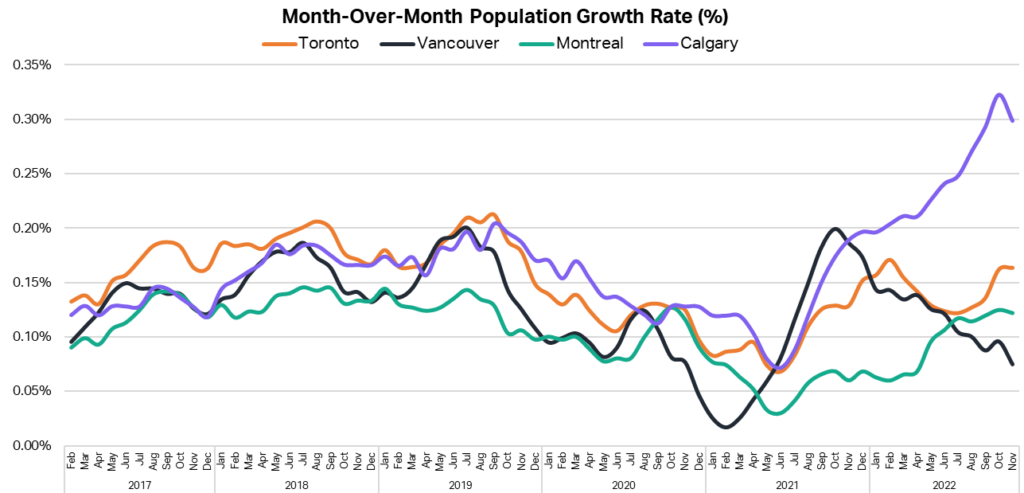

Population growth rates also tapered as interprovincial and international migration flows slow heading into December. Most notably, Calgary recorded the first reduction of month-over-month population growth rate since March.

That being said, Calgary continues to grow at a rate that is 1.8 times that of Toronto and 4 times that of Vancouver, signaling the continued trend of net interprovincial migration in-flow from Ontario and British Columbia that is largely driven by affordability concerns.

Canada’s Housing Market

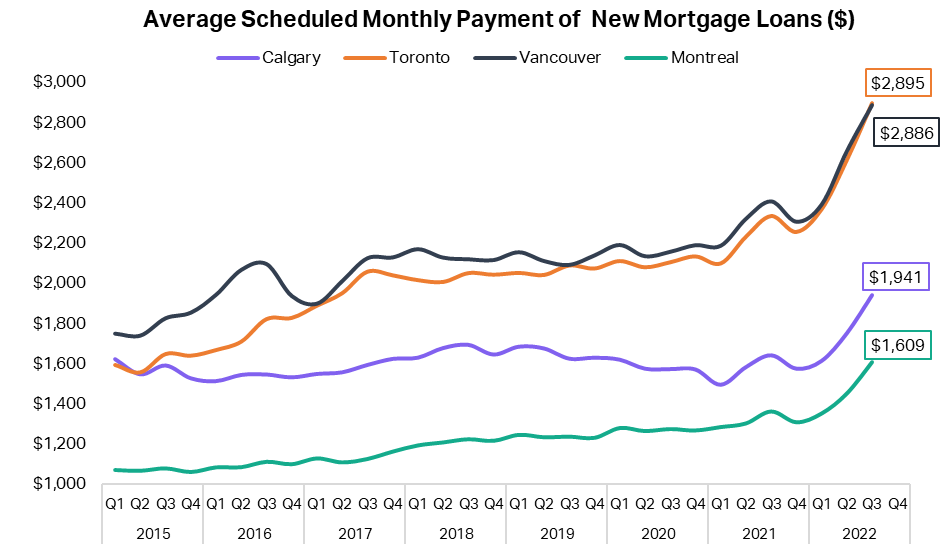

Rising interest rates and sticky housing prices have had a significant impact on the average scheduled monthly payments of newly issued mortgages which increased by 19.3 percent year-over-year on average.

On a nominal basis, this has resulted in an increase of $365 on average compared to mortgages issued in the same period of the previous year. It is expected that the Bank of Canada will announce a subsequent 50 basis point increase in the overnight rate on December 7th in an attempt to cool off the economy which all but dissolves any last prospects of a smooth landing.

It should be noted that the length and severity of an economic contraction experienced in the coming years will depend on the stickiness of inflation. The consistent reporting of a potential downturn is expected to have an inherent cooling effect as consumers will anticipate a sustained period of economic turbulence, and will likely curb spending and increase savings. For this reason, the severity of a looming recession may be reduced relative to historical instances when an economic contraction occurred with less warning (think 2008/2009).

Economic Impact

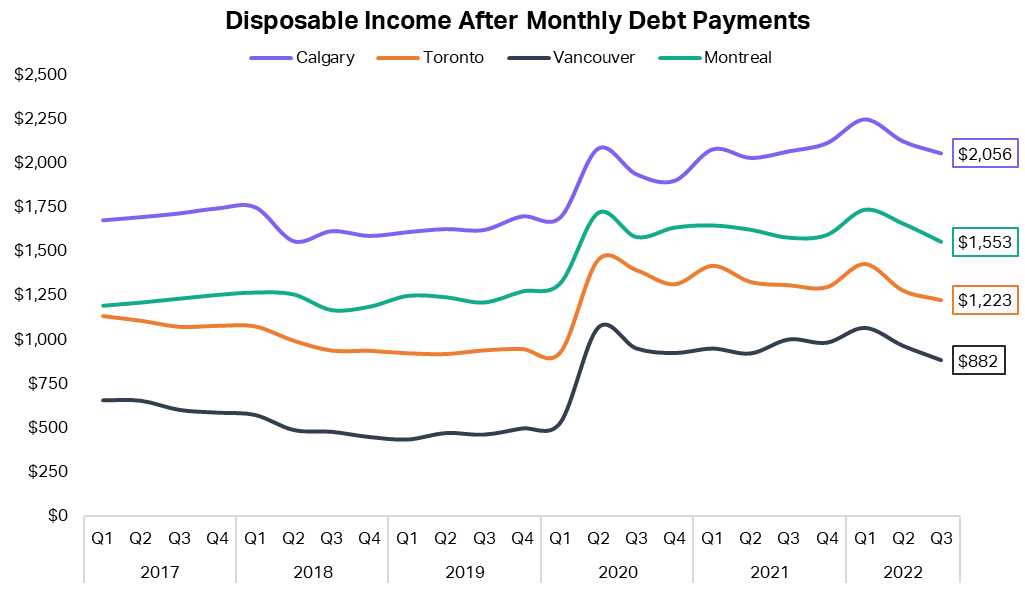

Rising interest rates and heightened inflation has increased the reliance on debt products to supplement consumer spending resulting in an increase in the amount of monthly scheduled debt payments by nearly 5 percent on a year-over year basis.

This increase in debt payments has led to an overall reduction in average disposable income per capita in all major markets. Average monthly debt is not inclusive of other consumer necessities such as housing utilities, insurance, groceries, childcare, medical bills, etc. and therefore is assumed to be the average amount of income available for these types of purchases.

The reduction in purchasing power due to rising interest rates and price inflation is considered to be the driving force behind the increase in interprovincial migration patterns that has Canadians searching for places to live where they can find some financial reprieve.

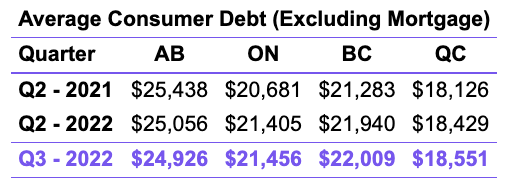

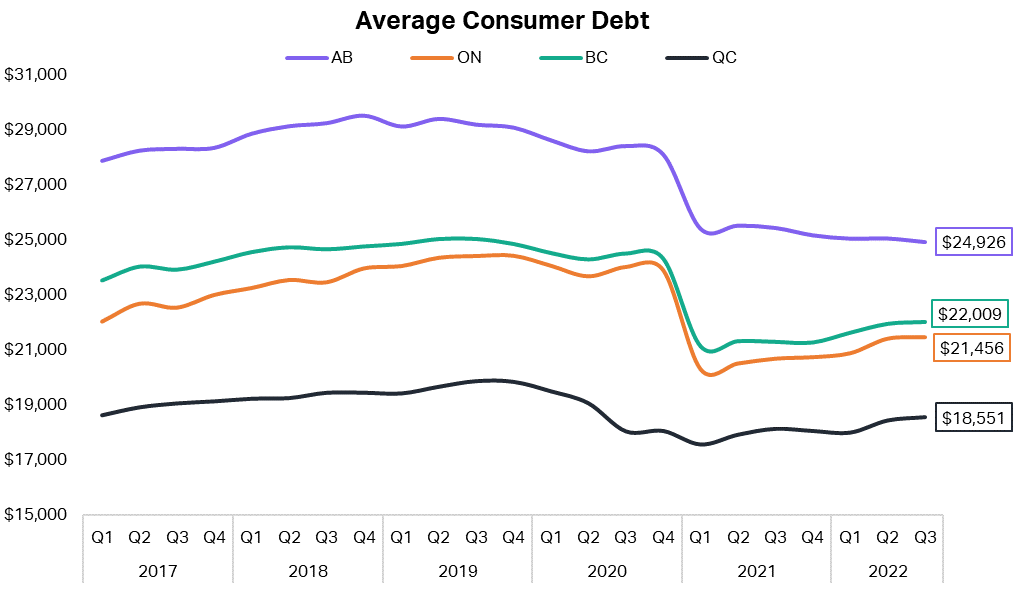

Average total consumer debt not including mortgages has increased by 3.7, 3.4, and 2.3 percent compared to the previous year in Ontario, British Columbia, and Quebec, respectively. Alberta’s average consumer debt decreased by 2 percent on an annual basis to $24,926 although it still maintains the highest average provincial debt per capita in Canada.

Calgary and Quebec City growing while Toronto and Vancouver shrinking during economic uncertainties

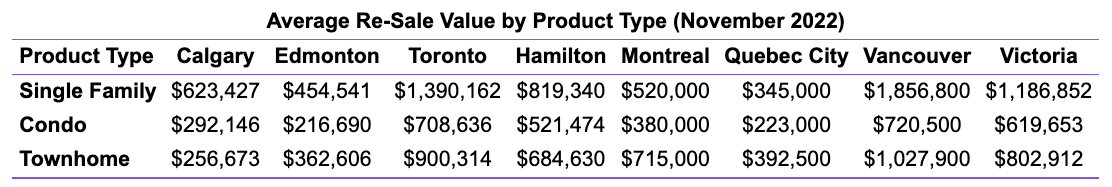

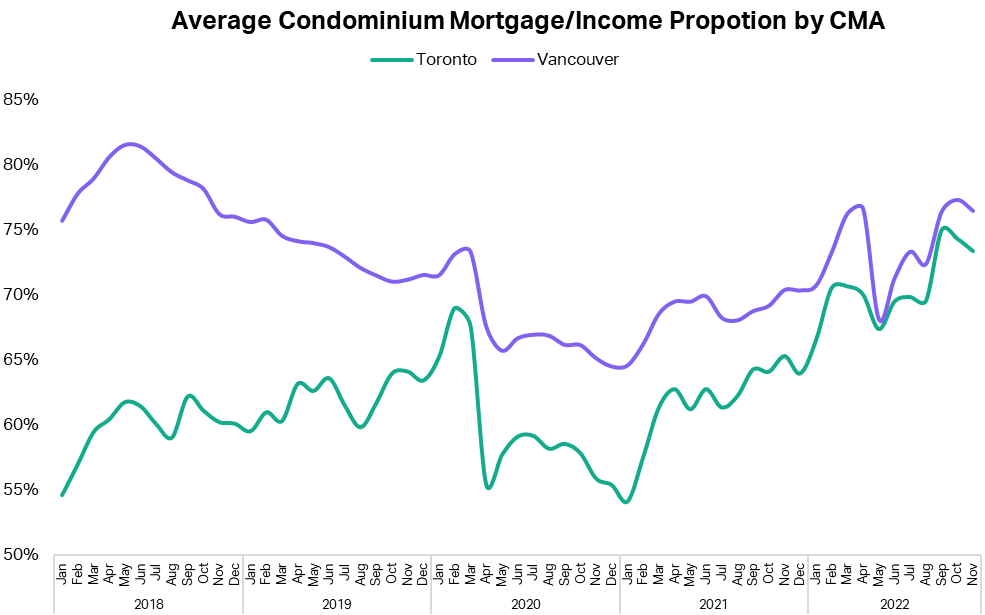

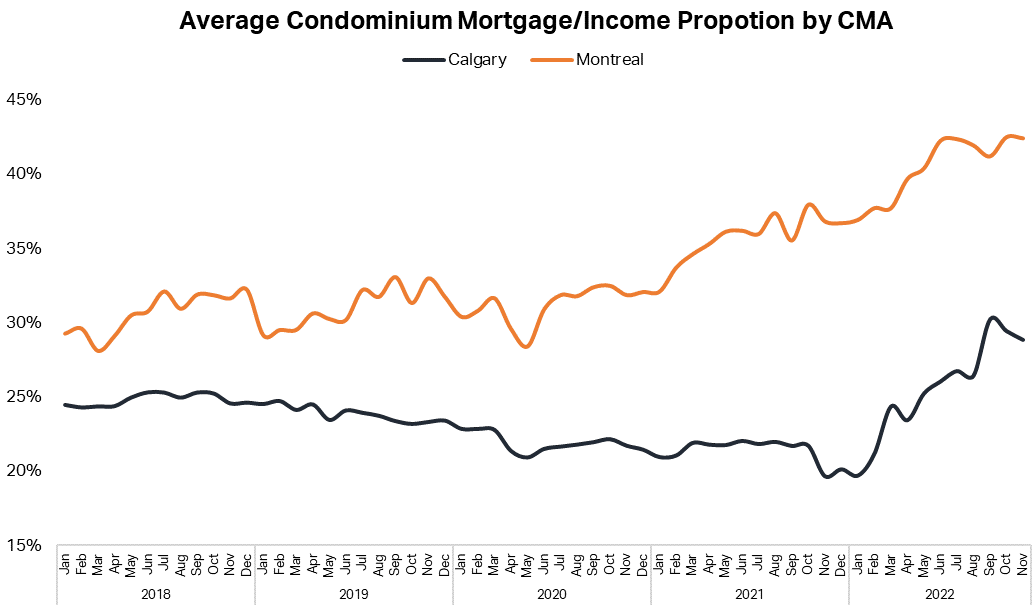

All major Canadian housing markets have softened on an annualized basis with the exception of Calgary and Quebec City, which are still 10.4 and 7.5 percent higher. These markets have experienced a substantial increase in housing demand due to their relative affordability to other major markets which has provided substantial upward pressure on pricing.

However, the increase in prices compounded with higher borrowing costs have had a significant dampening effect on total sales volumes. Average wages have increased by 2.6 percent on an annualized basis across British Columbia, Alberta, Ontario, and Quebec while condominium prices have softened across major markets which have offset the increase in interest rates and led to a reduction in the average amount of income required to meet anticipated monthly mortgage payments in the month of November.

Sales volumes for condominiums have increased in major markets due to demand elasticity which is pushing buyers away from larger product types like single-detached, duplex, and townhomes and into condominiums.

Jackson Cornelius is the Director, Consulting and Advisory (Canada) at Zonda Urban (Formerly Urban Analytics). For more information on the real estate market, please reach out to [email protected]

Want to Buy or Sell Your Home Without an Agent?

Welcome to Bōde

Bōde has created a marketplace to allow you to get transparent home data, set your price, and list your home on MLS (and 1000+ more sites). We will advertise your home and walk you through the whole sale process for 1% up to a maximum of $10K, only when the home sells.

Looking to buy? Bōde empowers buyers to purchase any Bōde property, themselves – at completely no charge.

With your free Bōde account, you don’t need an agent – you are completely in charge of your home sale or purchase and get to keep more of the money you invested in your home!

Get started at bode.ca

Why Bōde?

What homeowners are saying about Bōde

Jackson Cornelius is the Director, Consulting and Advisory (Canada) at Zonda Urban (Formerly Urban Analytics). For more information on the real estate market, please reach out to [email protected]