Written by Jackson Cornelius, From Zonda Urban

Real Estate Market Report | Canada | November 2022

Learn about how home sales and prices are impacted by Canada's economic picture

Rise in employment and consumer spending

Figures released last week showed Canada added considerably more jobs than expected, largely driven by the construction industry. This actually lowered the unemployment rate and accelerated wage growth across most major Canadian cities.

This will likely increase overall demand and consumer spending which will produce further inflation heading into 2023.

Raising consumer spending has the opposite effect the Bank Of Canada was hoping for following their ongoing interest rate hikes.

This will likely result in a further 50 basis point increase at the next BOC announcement in December.

Zonda expects the Bank Of Canada to wait and see the impact their previous rate hikes have had. It typically takes 6-8 months before material impacts are seen in the market.

Global recession on the horizon

It will likely be the case that due to ongoing geopolitical factors influencing global demand for fossil fuels, we will see a spike in gas prices and will likely be compounded with a flurry of layoffs from major corporations that will cascade into the throws of a global recession. At this point, the Central Bank may elect to hold firm on interest rate levels or may pivot to ease the impacts of economic contraction.

Canada’s housing market impacted unequally

While Canada’s most exposed housing markets will likely feel the brunt of the effects of a recession, those with a comparative affordability advantage (e.g. Alberta) are poised to weather the storm better relative to Ontario and parts of British Columbia.

Full detailed report from Zonda Urban

Canada’s Labour Market

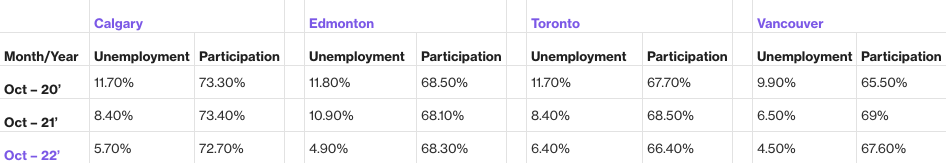

Canadian labour numbers released last week saw Canada add 113,000 new jobs that beat the modest estimate of 10,000 and was largely driven by the construction industry, which comes at a time when construction labour shortages persist throughout major markets. This also resulted in further suppression of the unemployment rate across all major markets and accelerated wage growth. Average YTD month-over-month average weekly earnings have increased by 0.25% (3.0% annualized), 0.18% (2.2% annualized), and 0.19% (2.3% annualized) in Alberta, Ontario, and British Columbia, respectively. While this may be welcomed news for consumers, it is almost the opposite effect the BOC was hoping for following an ongoing and aggressive rate hike cycle aimed at combating rampant inflation. These numbers do not indicate any contraction in demand and are likely to result in/add to persistent and sticky inflation as we move into 2023.

Canada’s Housing Market

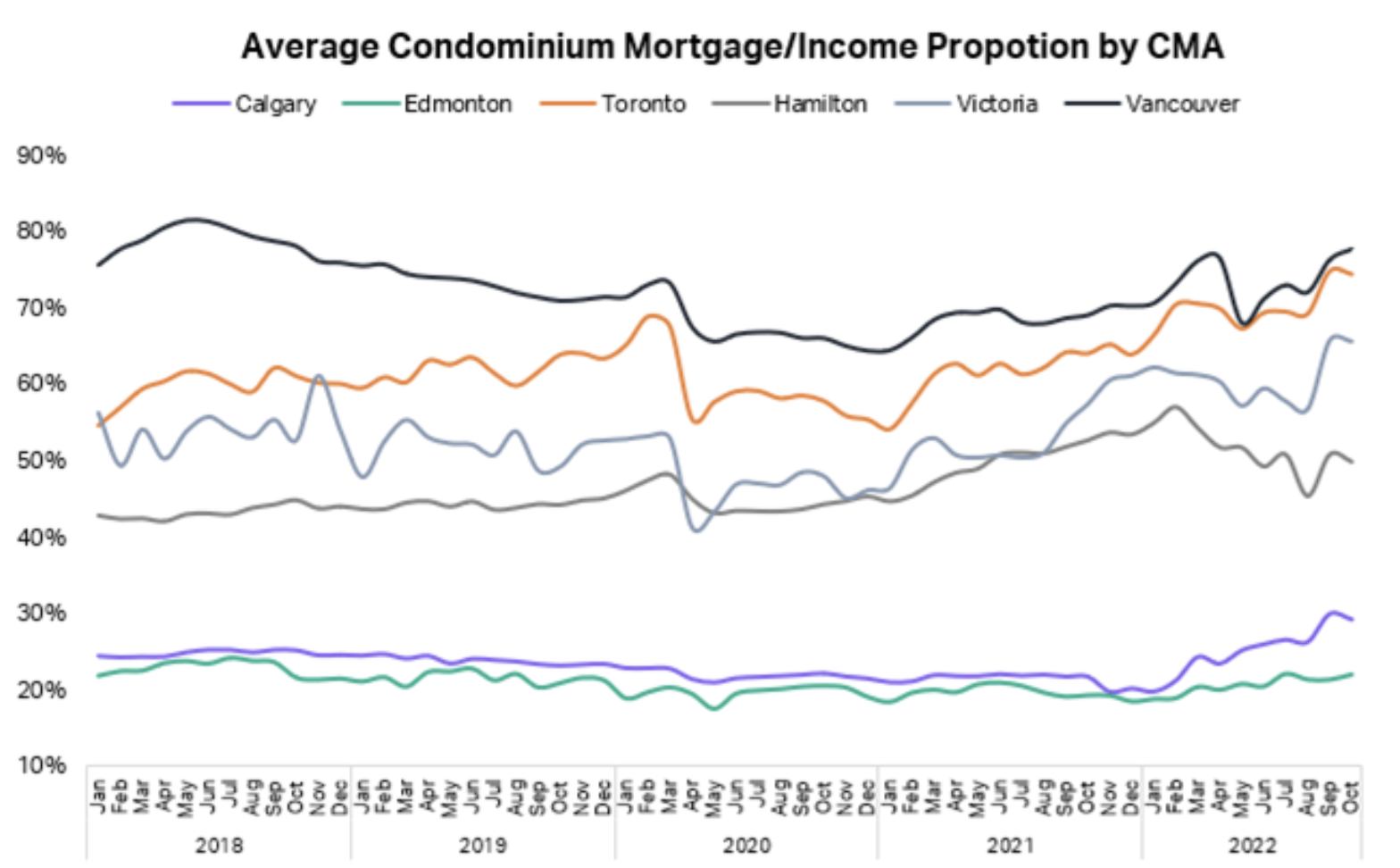

Average sales values in the month of October increased on a month-over-month basis in four out of six major markets across Canada, with the only exceptions being Hamilton and Vancouver. However, despite average resale values marginally increasing, total sales volumes, inventory, and new listings have plummeted from their previous highs recorded in March of 2022. This is largely due to a drawdown on existing inventory available in each market, leaving slightly higher-priced homes which have continued to be absorbed thereby placing upward pressure on overall housing prices. It should be noted that condominium resale values have decreased across all six major Canadian markets currently being tracked by an average of 2.2% on a month-over-month and are reflective of the true impact of rising interest rates and economic uncertainty, as this is a key product type among both entry-level buyers and private investors, both of which are largely affected by the current economic climate.

Economic Impact

The latest release of strong labour statistics reinforces the Central Bank’s monetary tightening policy through raising interest rates and will likely result in a further 50 BPS increase at the next announcement in December. The upcoming Christmas season will likely be the barometer for future policy depending on the rate of demand contraction experienced throughout the economy. It is Zonda Urban’s expectation that the BoC will likely sit on its hands and wait to see the impacts of the previous consecutive rate hikes that tend to have a +/- 6–8 month lag period before material impacts are seen in the market. As temperatures across the country drop entering the winter months, it will likely be the case that due to ongoing geopolitical factors influencing global demand for LNG, and other fossil fuels (and fossil fuel derivatives) will see a spike in gas prices and will likely be compounded with a flurry of layoffs from major corporations that will cascade into the throws of a global recession. At this point, the Central Bank may elect to hold firm on interest rate levels or may pivot to ease the impacts of economic contraction. However, while Canada’s most exposed housing markets will likely feel the brunt of the effects of a recession, those with a comparative affordability advantage are poised to weather the storm relative to Ontario and parts of British Columbia. While there is no crystal ball that can predict the outcome of the complex landscape the international community is actively trying to navigate, one thing that is for sure is that it is likely to be a bumpy ride.

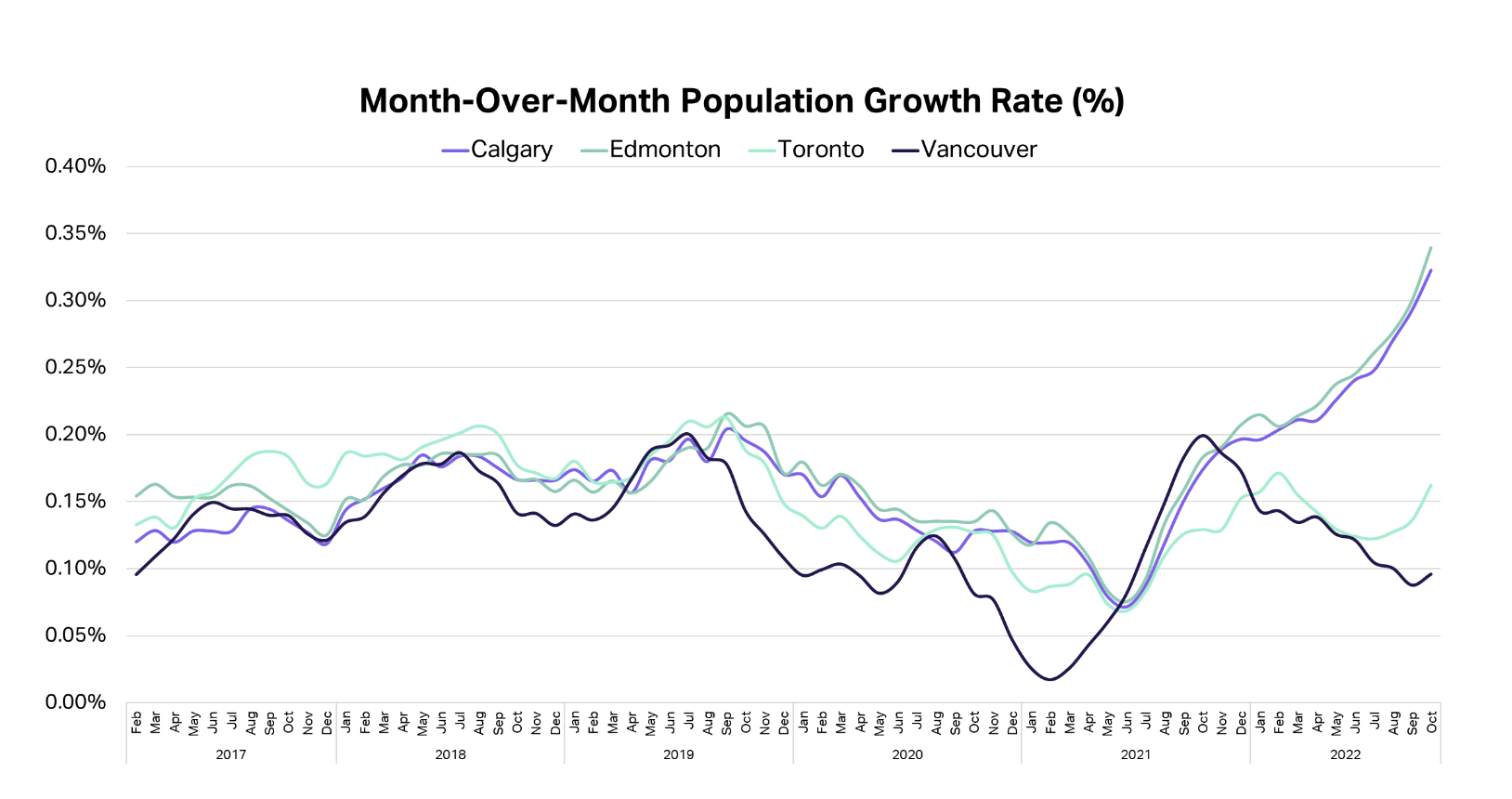

Calgary and Edmonton growing while Toronto and Vancouver shrinking during economic uncertainties

Jackson Cornelius is the Director, Consulting and Advisory (Canada) at Zonda Urban (Formerly Urban Analytics). For more information on the real estate market, please reach out to [email protected]

Want to Buy or Sell Your Home Without an Agent?

Welcome to Bōde

Bōde has created a marketplace to allow you to get transparent home data, set your price, and list your home on MLS (and 1000+ more sites). We will advertise your home and walk you through the whole sale process for 1% up to a maximum of $10K, only when the home sells.

Looking to buy? Bōde empowers buyers to purchase any Bōde property, themselves – at completely no charge.

With your free Bōde account, you don’t need an agent – you are completely in charge of your home sale or purchase and get to keep more of the money you invested in your home!

Get started at bode.ca

Why Bōde?

What homeowners are saying about Bōde

Jackson Cornelius is the Director, Consulting and Advisory (Canada) at Zonda Urban (Formerly Urban Analytics). For more information on the real estate market, please reach out to [email protected]