Written by Alan Kelly, Bōde’s Chief Economist

To understand what’s happening in the real estate market you have to look at supply and demand.

The best proxies for supply and demand are:

Supply

- New supply: New Listings (i.e. the number of homes recently listed for sale)

- Total supply: Inventory (i.e. the total number of homes listed for sale)

Demand

- Sales (i.e. the number of homes recently sold)

Supply & Demand

- Months of Supply (i.e. the number of months it would take to sell all current inventory at the current rate of sale)

These metrics are the best indicators of the health of the real estate market. Let’s look at what they show us.

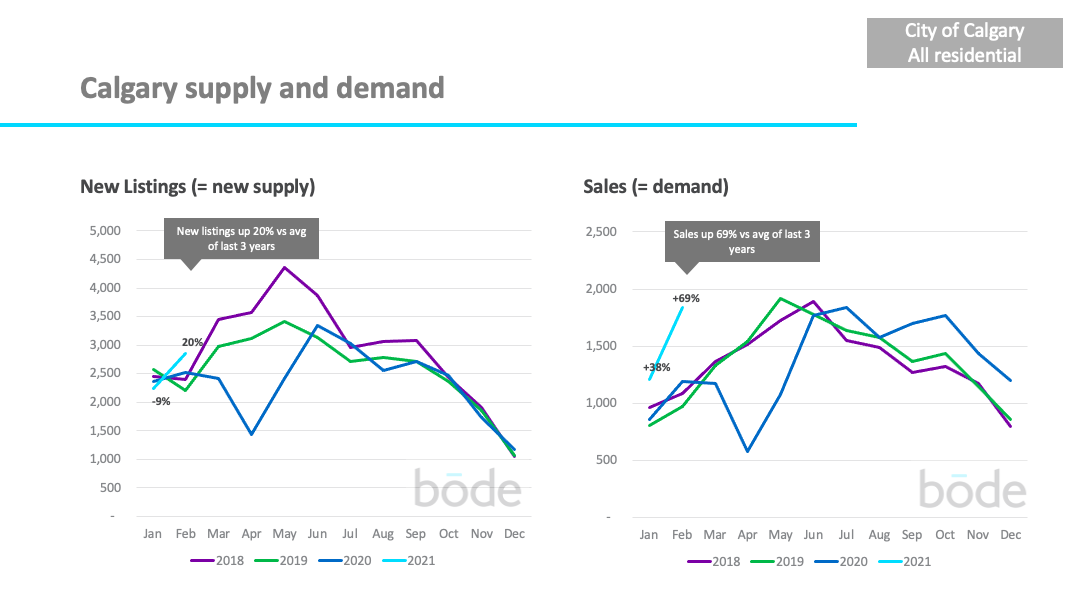

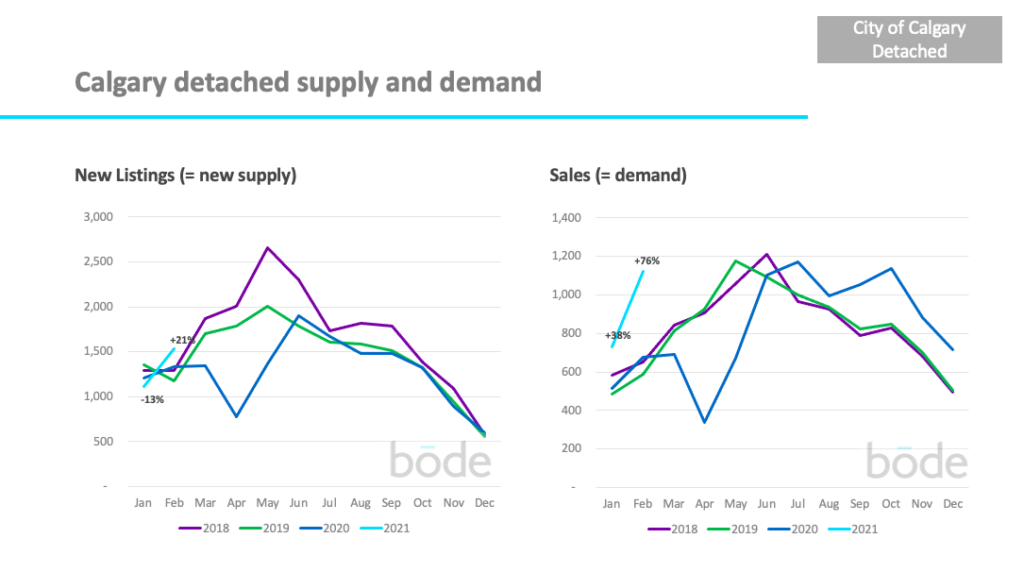

Calgary continues to see demand outpace new supply in the aftermath of the COVID-19 outbreak.

New listings in January were up 20% while sales were up a whopping 69% vs. the previous 3 years. Sales continued the strong trend they’ve been on since July 2020. We expect sales to continue to stay higher than usual for Spring 2021.

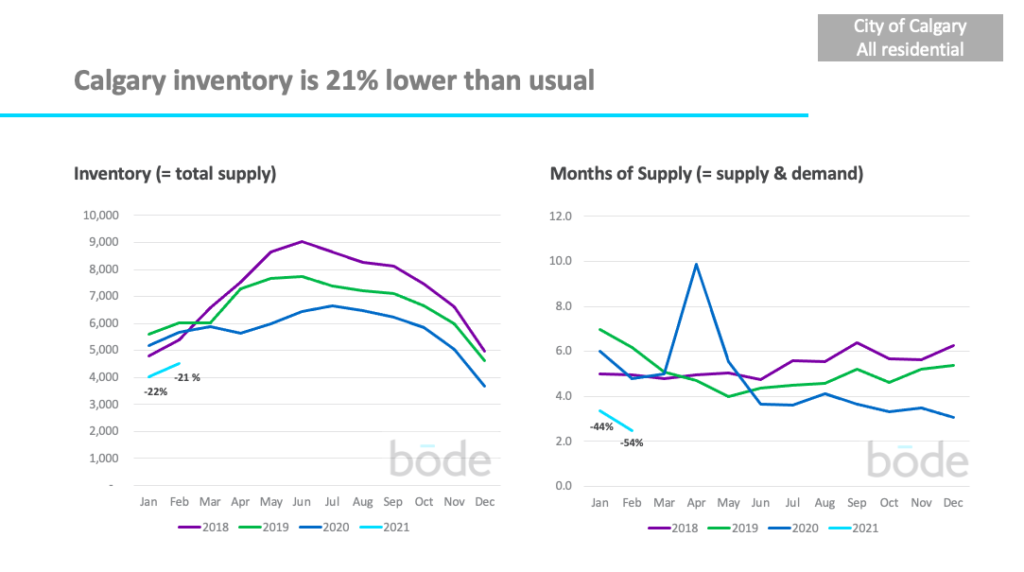

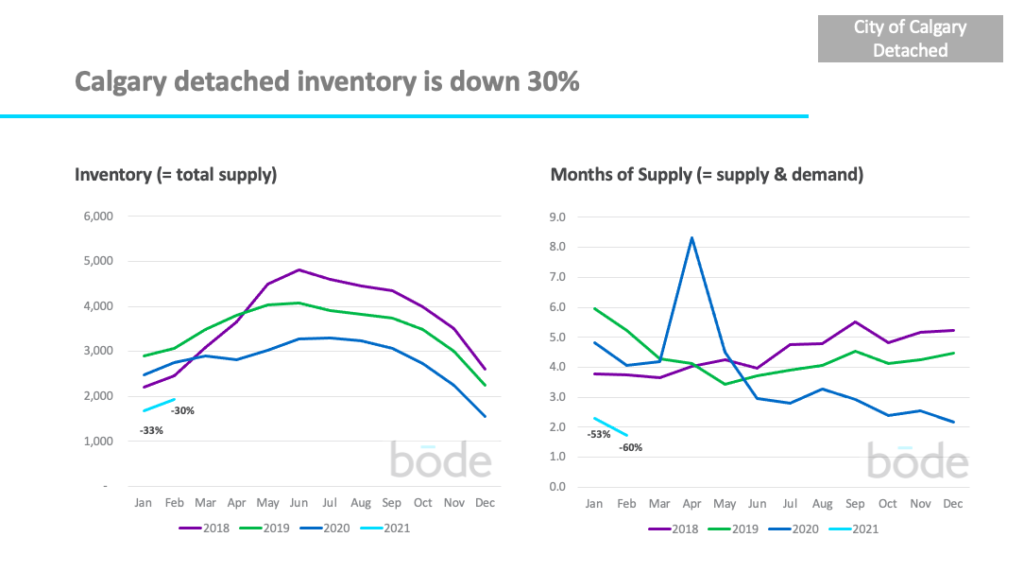

As a result of sales outpacing the number of new listings, the total number of homes for sale is down 21% compared to the average of the previous 3 years.

The combination of less supply and more demand has sent ‘months of supply’ even lower to just 2.5 months which is down 54% vs the previous 3 years.

Fewer months of supply generally makes conditions more favourable for sellers, while higher months of supply is more favourable for buyers.

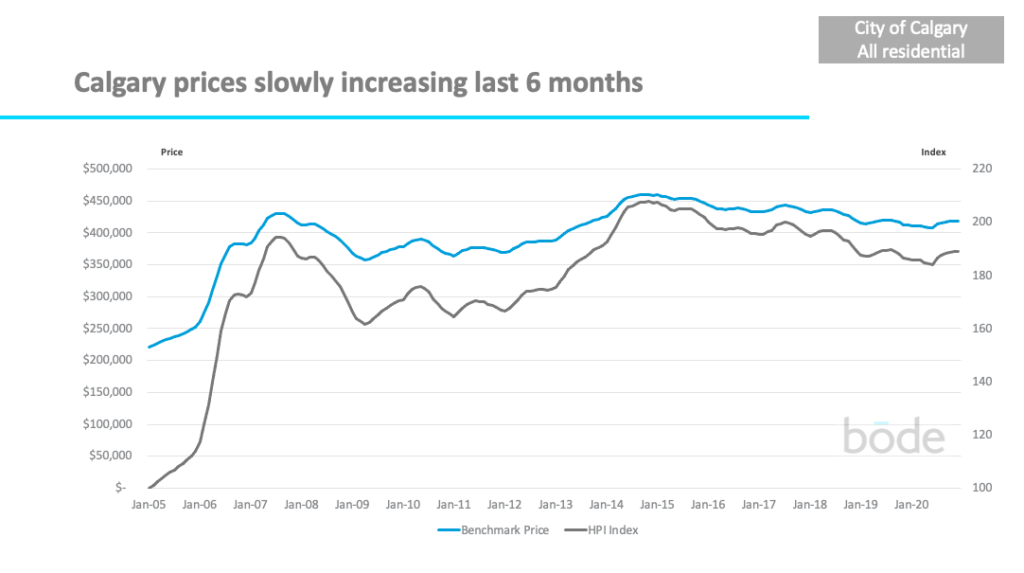

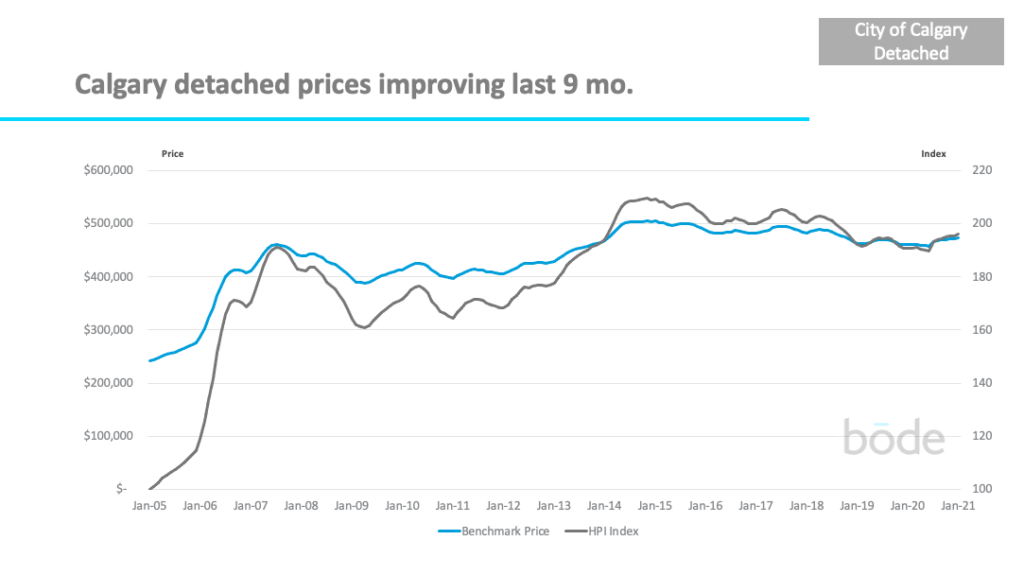

Overall, Calgary prices have been slowly increasing over the last 6 months. Overall prices are now back to where they were in August 2019.

What does this mean for sellers?

Right now supply is low relative to previous years, and demand is high which means it is a good time to sell your home. Sellers who price their home well will likely be able to sell quickly. However, your specific property value will be determined by market forces both within your community and against similar active listings. To find out what supply and demand look like for your specific community, click here.

What does this mean for buyers?

There are currently fewer homes for sale than there have been in previous years. This means active buyers need to move fast to beat other buyers to available listings. One way you can move faster is by booking viewings directly through Bōde, so you don’t have to wait for a realtor to schedule your viewings.

Market conditions vary substantially by property type, community and price range

Above, we’ve looked at the overall markets for Calgary, but different segments are performing very differently. Let’s look at a few examples.

In February, sales of detached homes were up 76% vs the previous years.

As a result, overall supply of detached homes is down 30% compared to previous years.

This has led months of supply to be down 60% to just 1.7 months, which means it’s one of the best times in years to be selling a detached home, and one of the toughest times to be buying as there’s considerably less inventory than normal to choose from.

This has led prices upwards, and they are now back to 2018 levels.

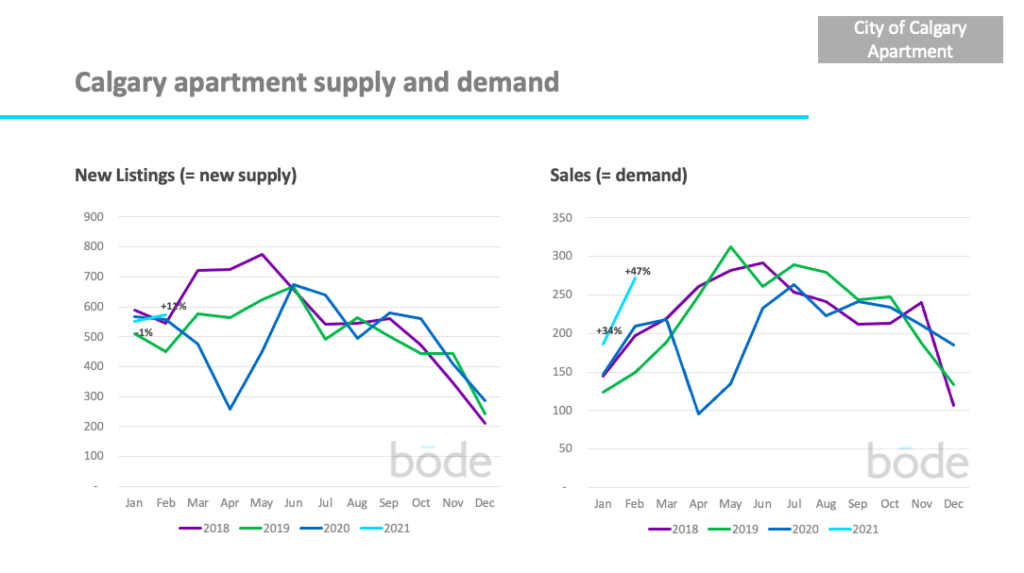

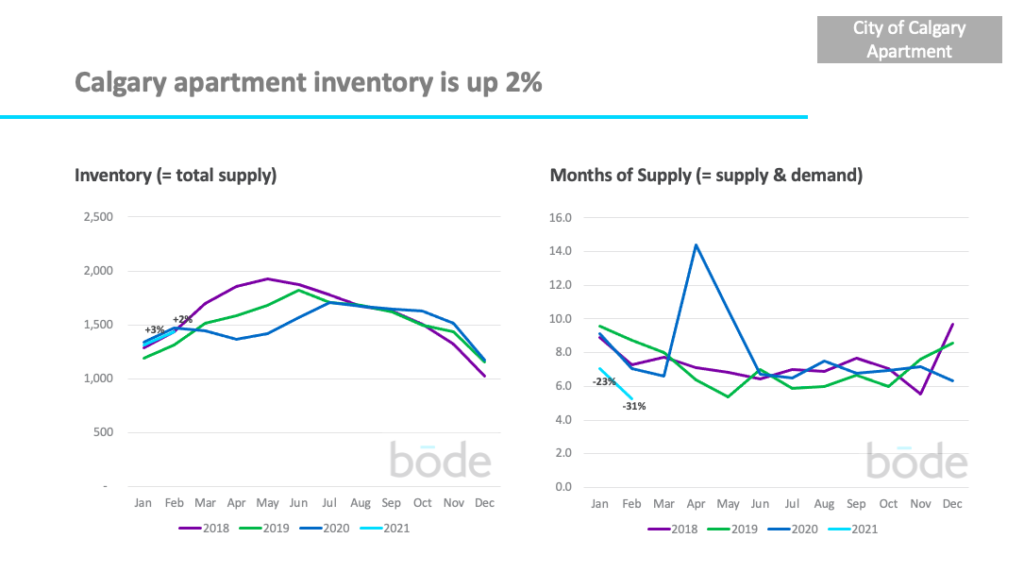

On the other end of the spectrum, there is currently 5.3 months of supply of apartments in Calgary – making it a buyers market.

The apartment market has been improving in 2021 relative to a very difficult 2020. Sales were stronger than usual for February (up 47%). Despite 3 good months of sales, most of 2020 saw more new listings than sales, so overall inventory (supply) of apartments is still up 2% vs previous years.

Buyers have a lot of apartment options which makes it more difficult for sellers to achieve the price (and speed of sale) they might have wanted.

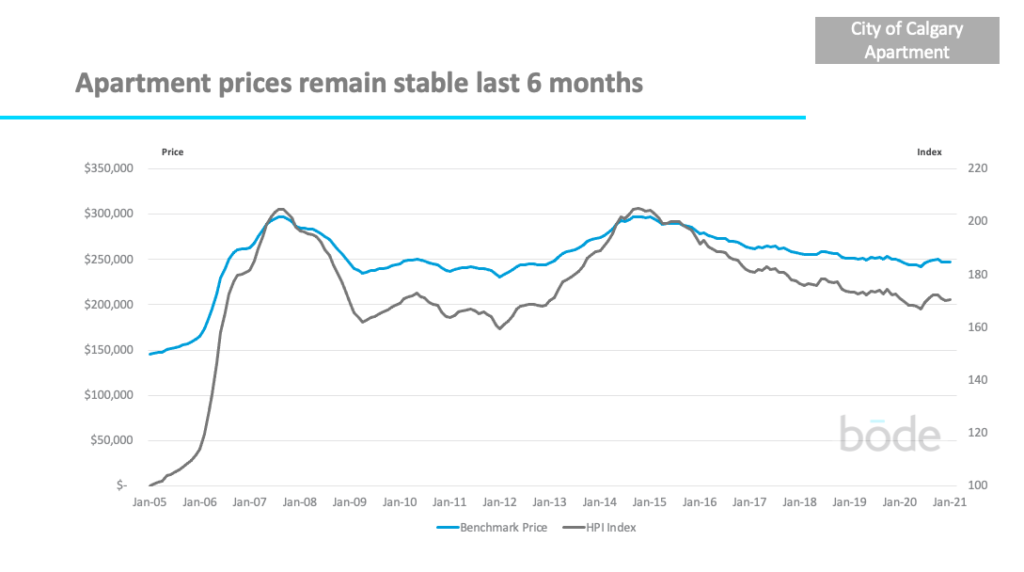

Apartment prices may be starting to stabilise after being on a downward trend since early 2015.

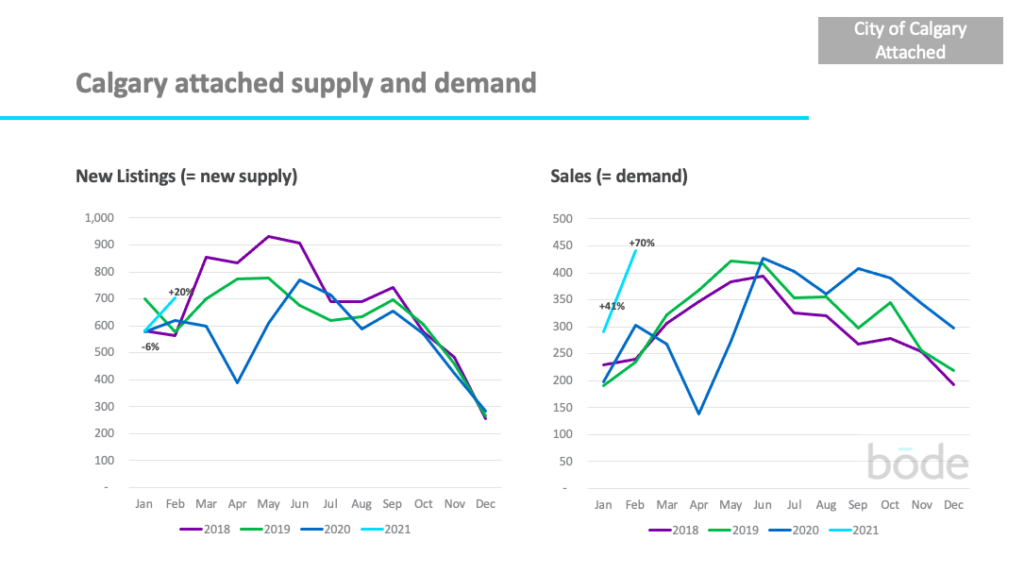

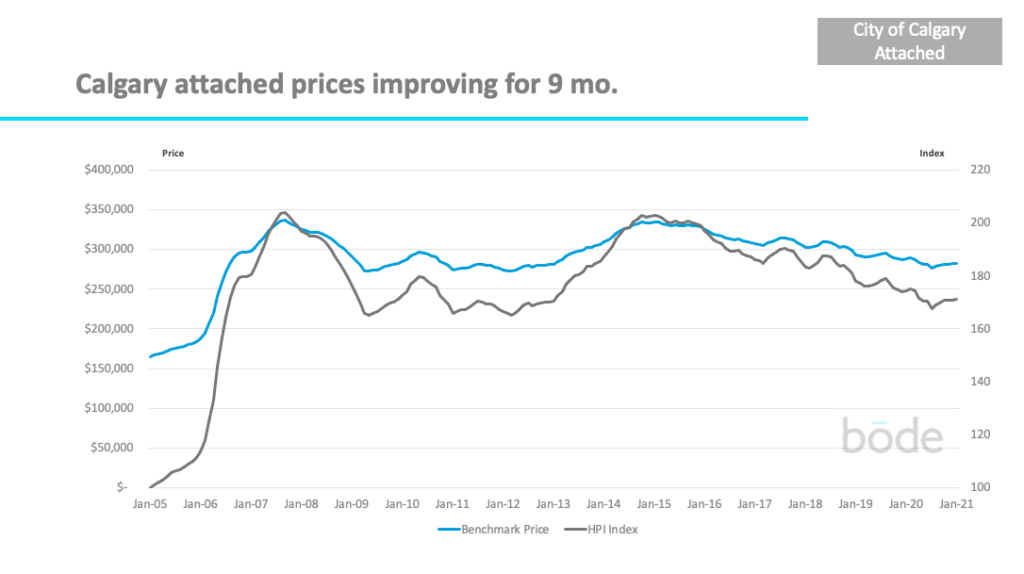

Attached homes (i.e. semi-detached or row homes) saw 20% more listings in February vs previous years. Sales were incredibly strong at +70% compared to the last 3 years.

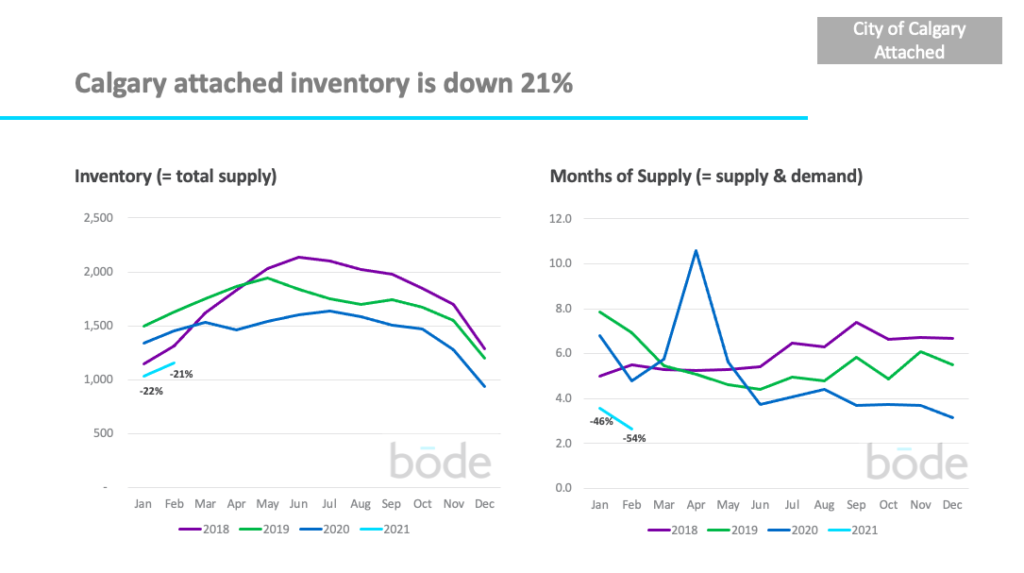

This caused total inventory to fall (-21% vs previous 3 years) and months of supply to drop from 3.6 to 2.6 months.

Prices for attached homes have been improving since July 2020.

In general, you’re in a much better position if you’re selling a detached or attached home right now compared to an apartment, due to less supply and greater demand.

However, what really matters is what’s happening in your specific local property market. There are some communities and price bands where detached homes are performing better/worse, and the same goes for apartments.

It’s critical to understand the dynamics in your local property market

To understand your local property market, you need to look at your local data. Head over to Bōde’s Market Data dashboard, the only place where you can see all the data yourself, including being able to filter on community, property type, and price range to see exactly what’s happening where you live.

You can also see the sold price of any home that has sold in the last 10 years using Bode’s Sold Data page.