THE ULTIMATE GUIDE TO PRICING YOUR HOME

How to set your list price and sell for the highest price

How to research open market value

Successful sellers know:

The key to accurate valuation is to see the market through the eyes of buyers.

Focus on finding facts because facts are what will give you the best insight into what buyers are seeing and thinking:

- What similar homes historically sold for are facts.

- What similar homes recently sold for are facts.

- What similar homes you’ll be competing against are facts.

- What similar homes are failing to sell for are facts.

In hot markets (where prices are rising) what buyers will be willing to pay will be above what similar homes recently sold for, but below what similar homes are failing to sell for.

In cold markets (where prices are falling) what buyers will be willing to pay will be below what similar homes have recently sold for, but potentially above what similar homes have historically sold for.

Where to find these facts

How to find out what similar homes ‘historically’ & ‘recently’ sold for

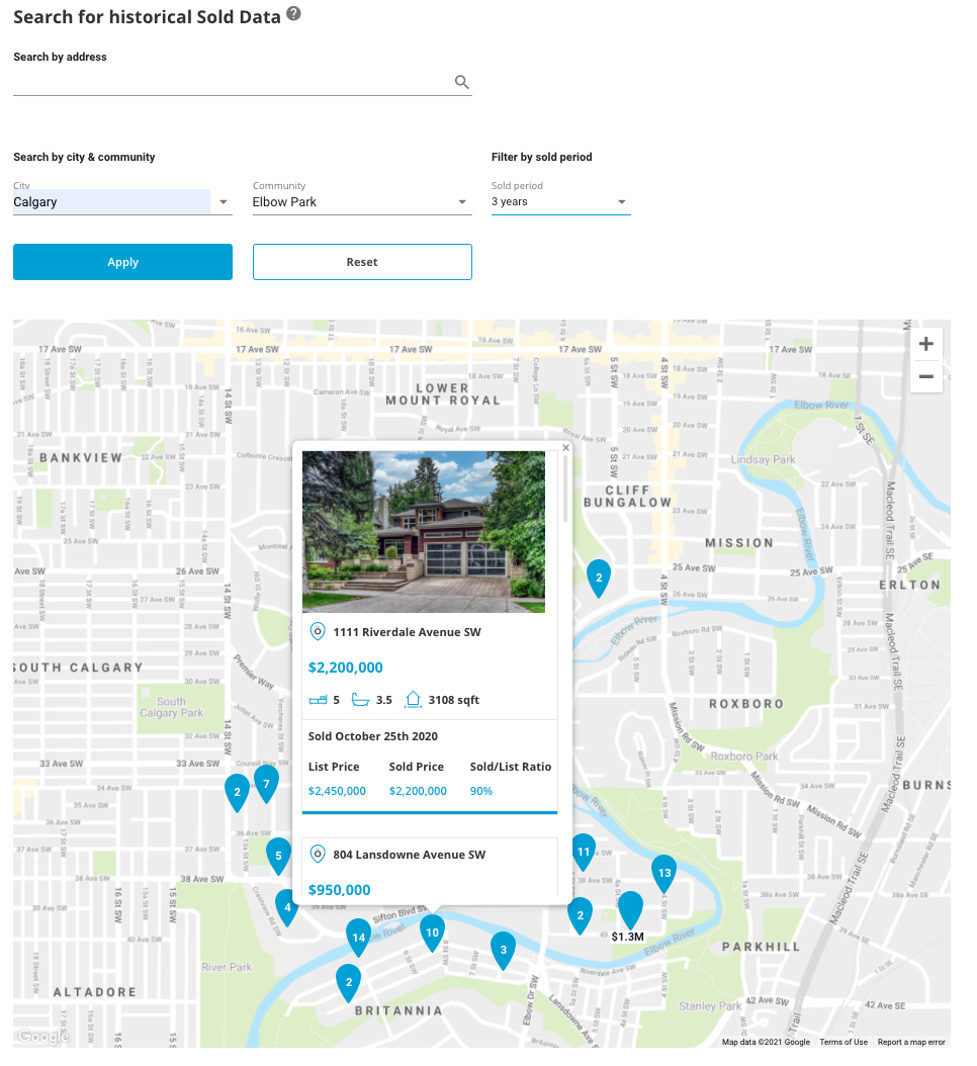

You can look up the sold price of any property that has sold in Alberta over the last 10 years using Bōde’s Sold Data tool.

This tool has every home that sold on market (i.e., on MLS/Realtor.ca and on Bōde). This is better than the data realtors have access to, and now you have access for free.

How to find the homes you’ll be competing against

Simply use the Bōde Comparables tool

OR

Search Bōde (or Realtor.ca) for property listed ‘for sale’. (Bōde includes all Realtor.ca properties, as well as listings not on Realtor.ca – so you will find more homes on Bōde)

Focus on looking for homes that are similar to yours and near yours (near = 0.5 km in urban areas and 5-15 km in rural areas).

You should look for homes with similar amenities and roughly the same size and number of bedrooms and bathrooms that are on the market now.

These are the homes you’ll compete with if you put your house on the market today.

Don’t lose sight that you’re looking at ‘list prices’ here and remember ‘list prices’ are NOT ‘sold prices’. In many cases the difference can be significant.

How to find out what similar homes are ‘failing’ to sell for

We’re looking to make this data available to you on bode.ca as soon as possible. In the meantime, reach out to [email protected] and we will send you this data for your particular home.

Here are the principles:

In cold markets, anything on market and unsold longer than 90-120 days is probably overpriced.

In hot markets, anything over 40-60 day is probably overpriced.

How to realistically compare your property to the competition

Step 1:

Fire up bode.ca and find all the property you’d go look at if buying your house all over again.

The industry phrase is searching for ‘comps’ (comparable property).

Step 2:

Study the details carefully and even make copies of them if you want (they will come in handy when buyers/realtors come round).

Your ‘comps’ should all fall neatly into a nice tight price range.

However, there will be one or two properties that look like “comps” but priced much higher or lower than the rest.

There is always a reason for this!

It’s usually that a seller is simply asking too much money or that there is something wrong with the property.

Step 3:

Put these ‘freak comps’ to one side because they will give you a false impression of what your house is worth.

Objectivity is key

To help you further, here are the top reasons a buyer would be willing to pay more for a property (that at first glance looks similar to yours):

It’s in a better location which might be views to one person or access to schools for another.

- It has a garage or off-street parking.

- It has private outdoor space (especially if it’s a large south-facing yard).

- It has an en-suite bathroom.

- It has double bedrooms (min size 2.7 x 2.7m).

- It has a larger internal square footage.

- Detached is better than semi-detached which is better than end of row, which is better than mid-row.

- It has newly fitted bathrooms or kitchens.

- It has a large kitchen you can eat in.

- It is newly decorated throughout tastefully.

- It is well maintained.

- It has double glazing that compliments the style of the house (e.g., not UPV on a period property).

- It has an alarm system.

- It has superior views (i.e., over green space as opposed to a road, railway or eye-sore).

You don’t need to know exactly how much extra value any of these things would add (many are subjective anyway).

You just need to be critical and realistic about why your competition could command a higher or lower price tag than your own property.

Remember…

…Property valuation is just applied guesswork!

As long as you’ve looked at the correct information sources, your opinion will be robust and form a great base from which to fine tune.

Helpful research tools

Over and above Bōde’s Sold Data and Comparables tools, the following will come in handy:

Bōde’s Market Data –

- This helps you look at supply and demand in your local community.

- You can see how many homes are on the market, their average ‘days on market’, how many have sold recently, and how long they took to sell.

- You can see the current average list price per sqft and the recent sold price per square foot – which can give you another benchmark for your pricing.

- Overall, this gives you a feeling for how hot or cold the market you’re looking at is.

Using $/sqft to value property

While this is a useful datapoint, it is not a perfect valuation method primarily because homebuyers tend to evaluate the number of bedrooms as more important than square footage.

All other things being equal, most buyers will view a 3 bed as more valuable than a 2 bed etc.

However, comparing your home to others recently sold (and currently for sale) based solely on a $/sqft basis, can be a handy way to build a rough estimate of your home’s value.

t’s also a useful way to provide context when comparing different areas of a city or the country.

Just don’t make the mistake of thinking this is gospel.

Not all square feet are created equal

When performing this sort of analysis, keep in mind the following factors:

- Uninhabitable square footage is less valuable that habitable square footage (eg. bedroom sqft are more valuable than hallway sqft which are more valuable than void space sqft).

- Square footage with restricted ceiling height is less valuable than square footage with full ceiling.

- Newly modernised high spec square footage is more valuable than square footage in need of modernisation.

- Configuration and generosity of room sizes will also have an effect on value.

- Don’t assume floor plans are accurate – They are not.

- What’s more they may not all be measuring the same thing. They could be measuring external gross, gross internal or net internal area (make sure you know what you’re looking at).

Key takeaways:

- $/sqft calculations should be used only as a guide (a point worth keeping in mind when buying too).

The Complete Ultimate Guide to Pricing your Home

Now that you’ve read this, you’re way ahead of all the other sellers who will be making the many mistakes above. You have everything you need to successfully sell at the right price – go and make it happen!

If you have any questions, feel free to reach out to our team of experts at [email protected].