This article is written for those homeowners considering a move to a bigger home. Specifically, why you might consider doing this during a down market.

A down market is one where real estate sales are sluggish, inventory outweighs demand, and there is downward pressure on values. You will often hear this referred to as a “buyer’s market”.

While certain price bands of the Alberta real estate market are currently performing very well (detached homes priced between $400k – $650k, for instance), there are other segments (anything over $1M) that are certainly underperforming.

As a current homeowner, you may be reluctant to list your home under these conditions. Understandably so. You will net less proceeds from the sale than you might have just a year ago. Allow me to explain why I recently bought and sold in a down market and why you might consider doing the same.

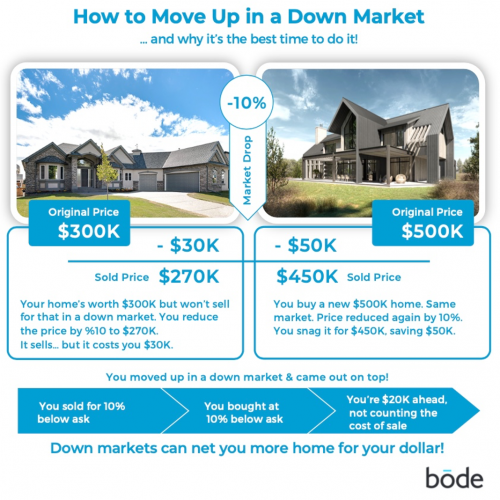

In the following example, a seller sells a $300k home and moves up to a home valued at $500k.

By doing so, you may come out on top:

- A seller sells their home for $30,000 less.

- The seller buys a new home for $50,000 less

- Seller is $20,000 ahead, not counting the costs of sale.

Setting the global pandemic aside, Alberta’s real estate market has historically been more cyclical than other Canadian markets. Perhaps you recall the impacts of the Kyoto protocol negotiations at the turn of the millennia or the impact of the 2008 recession when the price of West Texas crude plummeted from $167 to $51 per barrel.

For the sophisticated investor with general optimism around the future of energy prices and underlying economic fundamentals of the province, these swings provide a wonderful opportunity to move up or purchase homes at relatively inexpensive levels.

Now, if you are considering this strategy, consider your options on both the sale and purchase.

By choosing to hire an agent to represent you on the sale and the purchase, you will ultimately pay $24,000 in commissions. $13,000 on the listing of your existing home, and $11,000 on the purchase. These numbers are based on typical agent commissions in the province. Yes, I understand the payment of a commission on the purchase will be made by the seller, but that amount is what your agent may earn. It’s reasonable to assume you can negotiate this amount from the purchase price if you approach a seller as a self-represented buyer (as the seller will net the same proceeds).

Opting to work with Bōde, you are in the best position to attract a buyer without an agency agreement. You will pay just $3,000 on the listing of your existing home. On the purchase of your new $500,000, the effective list price is $489,000 assuming the seller is offering a typical commission. It does not cost a self-represented buyer anything to use the tools to purchase any MLS-listed home in the Bōde marketplace.

$24,000 of fees the old way.

The new way? Pay $3,000 in fees to list and effectively pay yourself the buy side of $11,000. $8,000 in your jeans. $32,000 of value.