In addition to the immense demand on our healthcare system, The COVID-19 Pandemic has created a unique set of economic forces that have driven historic growth in inflation that we haven’t seen for 40 years.

Inflation is typically driven by one of the three effects on the economy:

Demand Pull Effect

Demand-pull inflation occurs when an increase in the supply of money and credit stimulates overall demand for goods and services in an economy to increase more rapidly than the economy’s production capacity. This increases demand and leads to price rises.

Cost Push Effect

Cost-push inflation is a result of the increase in prices working through the production process inputs. When additions to the supply of money and credit are channeled into a commodity or other asset markets and especially when this is accompanied by a negative economic shock to the supply of key commodities, costs for all kinds of intermediate goods rise.

Built in Inflation

is related to adaptive expectations, the idea that people expect current inflation rates to continue in the future. As the price of goods and services rises, workers and others come to expect that they will continue to rise in the future at a similar rate and demand more costs or wages to maintain their standard of living. Their increased wages result in a higher cost of goods and services, and this wage-price spiral continues as one factor induces the other and vice-versa.

In Canada, we are experiencing both “Demand-Pull” and “Cost-Push” simultaneously, if both these effects persist we risk the “Built in Inflation” effect which is very difficult to reverse without taking significant fiscal cooling measures.

Demand-Pull in Canada

As of April 2022, according to the Bank of Canada our economy is outperforming expectations in terms of record low unemployment of 5% (down from 13% when the pandemic struck) and 3.1% GDP first quarter growth outpacing our economy’s growth potential.

Cost-Push in Canada

International supply chain disruptions and shortages emerged as much of the world economy reopened after the initial lockdowns caused by the pandemic. The global recovery sparked severe supply issues in key sectors such as energy, electronics and many consumer durables. The war in Ukraine has further amplified supply issues, while causing prices for oil, wheat, fertilizer and other production inputs to soar.

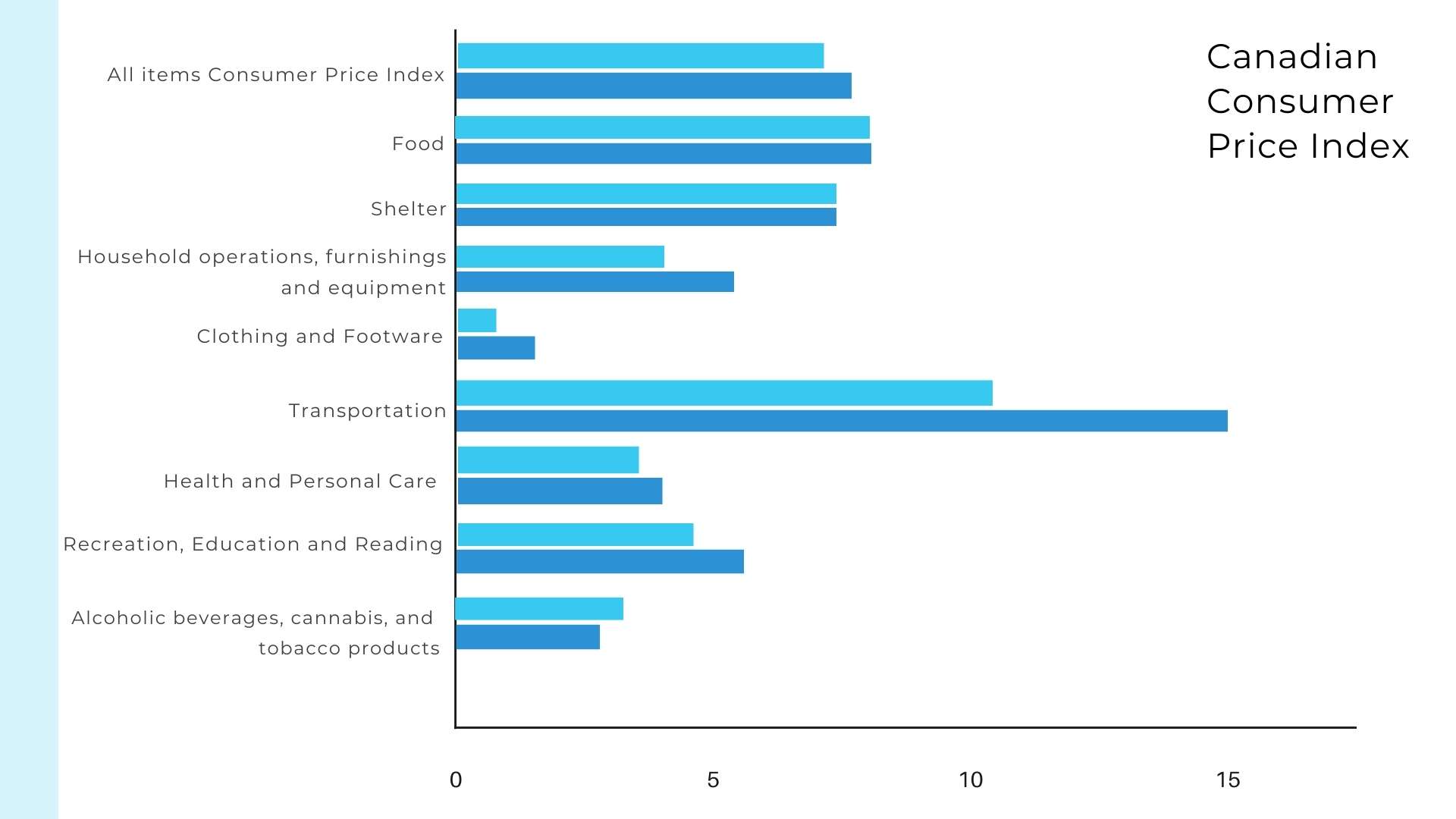

Let’s look at how this has affected the key components of the Consumer Price Index in Canada which totaled 7.7% in May 2022 versus our target of 2%:

Household operations, furnishings and equipment, have grown from 4.1% to 5.5% month over month.

How does this unique inflationary environment affect the residential real estate market in Canada?

It is important to note that home price changes are not included in the CPI calculation as homes are considered assets. It is helpful to understand both the increase in your home management costs and your home price trends in concert to have full perspective on the financial implications as a current or prospective homeowner.

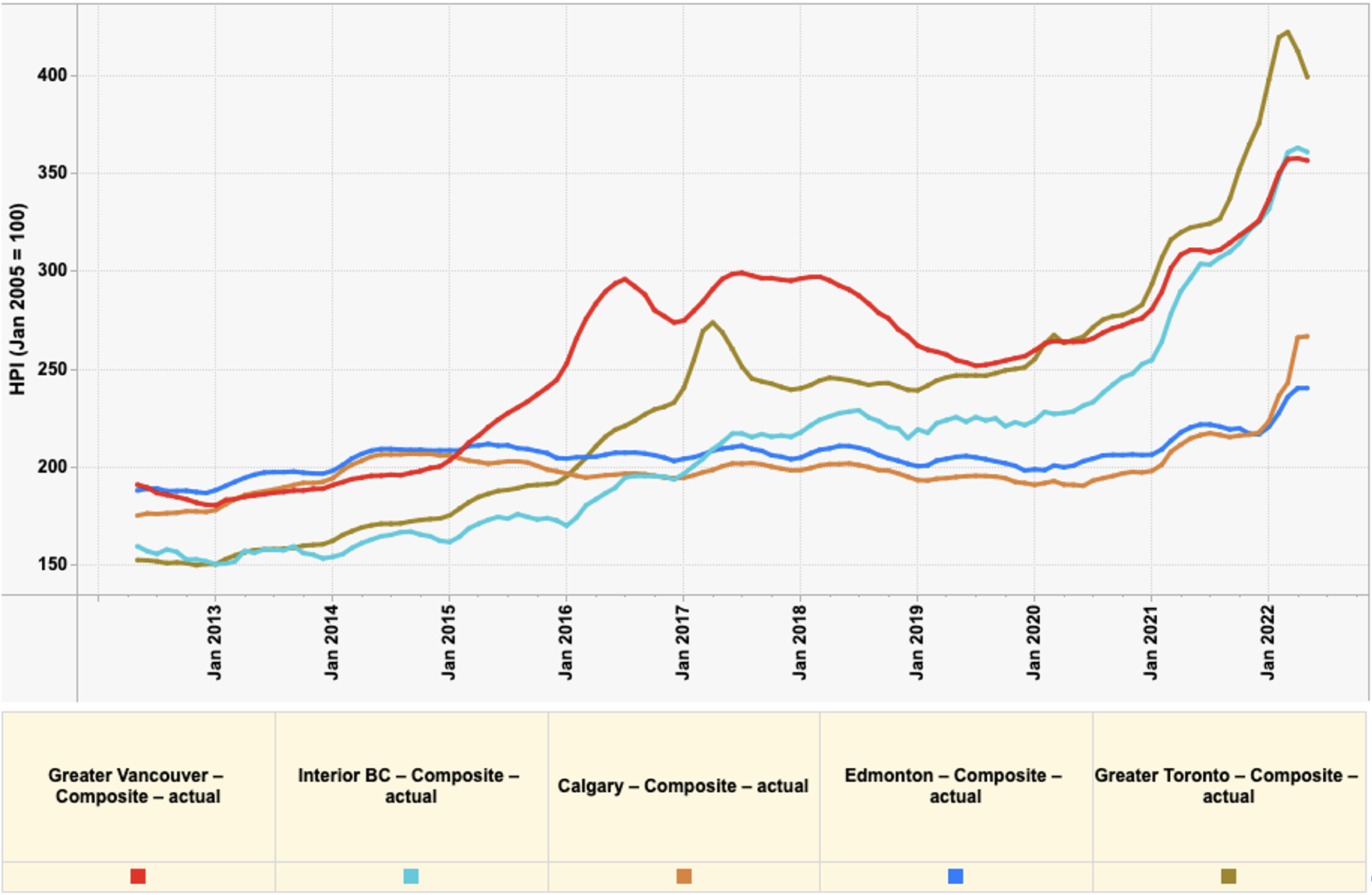

Let us look at what has happened to home prices in Calgary, Edmonton, Vancouver, Interior BC and Toronto over the past 10 years:

As you can see pricing has leveled off in each of these markets in the past 2-3 months as a combination of more housing supply comes back on the market and interest rates have risen making it more expensive for Canadians to purchase property.

Homeowner Implications

If you have owned your property in any of these markets for over the past 5-10 years you have likely experienced significant appreciation more than offsetting your rising costs to manage your home, especially if you have a fixed interest rate below recent increases. In other words, Canadian inflation to date has helped homeowners more than it has hurt.

Summary

This analysis has focused on the broader national implications on our economy as well as looking at a handful of Canadian cities/areas to provide broader perspective. In order to truly understand your situation, best to track the value of your specific property to be empowered and confident to make important decisions. Irrespective of the factors explored in this document, it is critical to maximize the value of your home by controlling the experience and significantly reducing commissions.